About Chainbase Staking

Chainbase Staking supports services for over 20 public blockchain networks and protocols. We manage assets worth more than 250 million US dollars, and we are committed to providing services that exceed the top service level agreements. We work closely with the ecosystem, and we are not only a provider of validation nodes, but also a partner dedicated to jointly building a stronger and more vibrant ecosystem.

Our partners include industry-leading companies such as Lido, SSV, Obol, Stader, etc., jointly we build a safer and more efficient Staking and Restaking Ecosystem.

Institution-grade Solutions:

- Non-custodial private key: On our platform, users maintain full control over their private keys, ensuring that the safety of funds is entirely in the users’ hands. Chainbase is responsible for verifying the operation of the nodes, thus elevating the users’ fund security and operational independence to the highest standard.

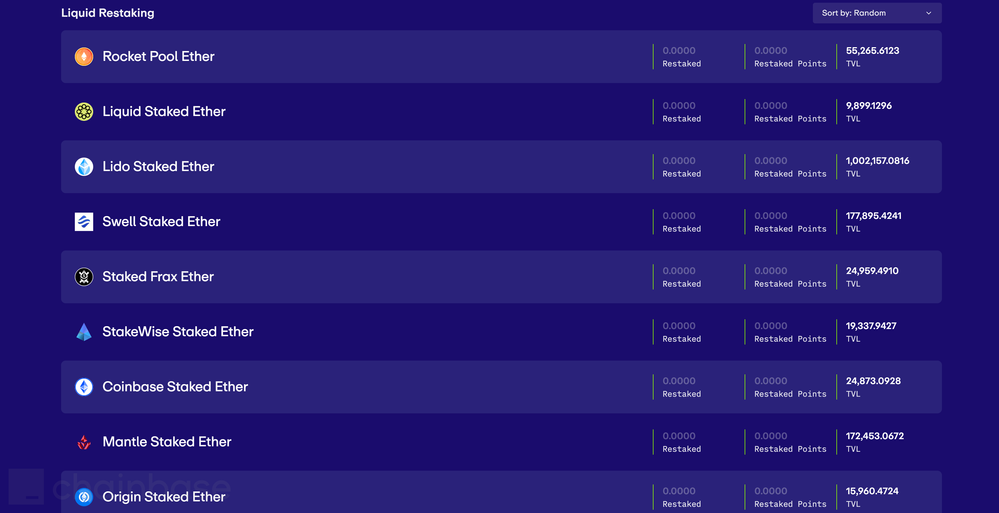

- Liquid Staking scheme: Our service supports users have participated in Liquid Staking, thereby gaining additional rewards. This scheme not only increases the earning potential of assets but also provides users with flexible fund management options, enabling them to effectively utilize market opportunities.

- Distributed Validator Technology (DVT): Using diversified client execution layers (Geth, Besu) and consensus layers (Prysm, Lighthouse) to minimize loss caused by single points of failure.

- 7X24 Monitoring Service: Ensure the stable operation of nodes and maximize profits.

- MEV-Boost Infrastructure: Use MEV to achieve higher annualized returns (APR) for customers.

- Rates and Liquidity:

- Competitive Funding Rates: No node operation fees, no consensus layer commissions, only some execution layer rewards are charged.

- Excellent Withdrawal System: Users can choose to exit the node at any time (the withdrawal time of Ethereum verification nodes needs to be adjusted according to the on-chain situation).

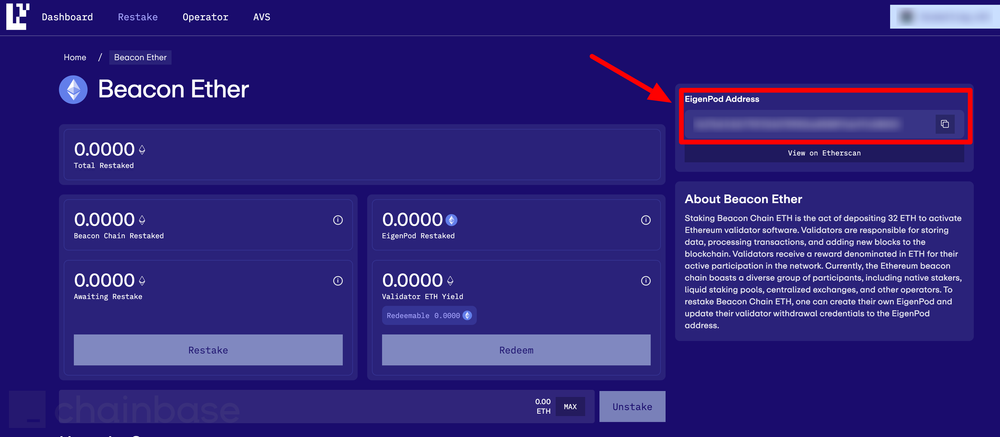

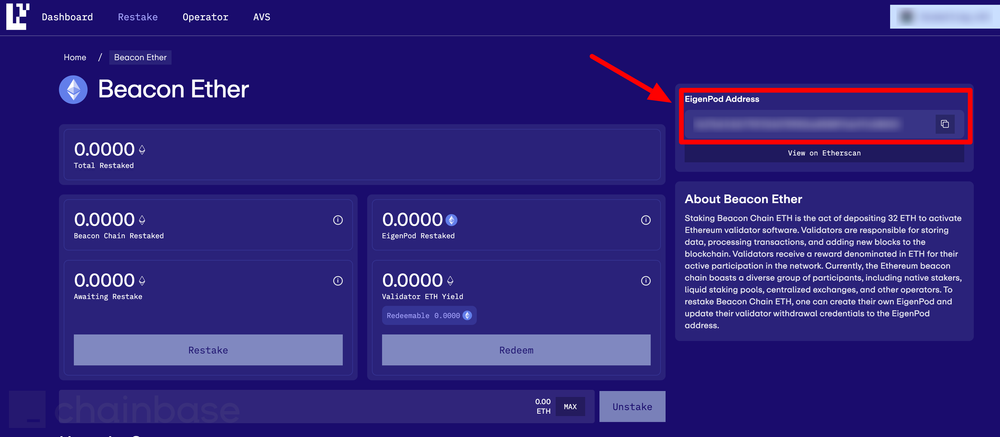

What is Eigenlayer?

Eigenlayer is a pioneering layer built atop existing blockchains like Ethereum that enables scalable and flexible security protocols. This innovative layer allows users to reuse the existing security of Ethereum to secure new and existing chains or layer-two protocols without creating new validators. Eigenlayer enhances the capability of Ethereum, enabling functionalities like staking on external services directly from Ethereum validators. This approach not only broadens the utilities for validators but also introduces a more interconnected and resource-efficient ecosystem within the blockchain space.

Understanding Native Staking vs. Liquid Staking

Native Staking

Native staking refers to the traditional process of locking up cryptocurrencies, particularly in proof-of-stake (PoS) networks, to support the network's operation and security. When you engage in native staking, you commit your tokens directly to the blockchain, which then uses them to validate transactions and create new blocks. This type of staking usually involves a lock-up period during which your tokens are not accessible, meaning you cannot trade or utilize them in other capacities. The rewards for native staking are typically in the form of transaction fees or new tokens, reflecting your contribution to the network's stability and security.

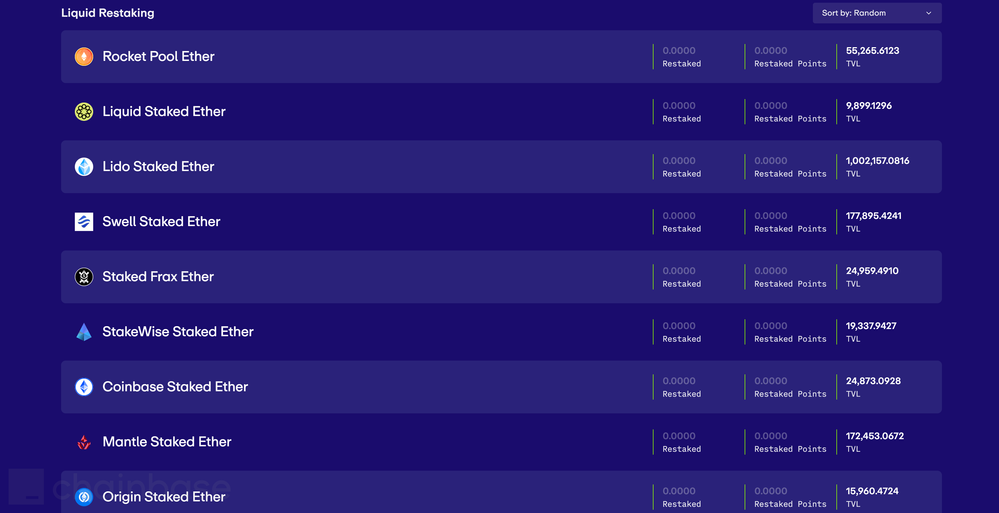

Liquid Staking

In contrast, liquid staking is a more flexible iteration of the staking process. It allows participants to stake their cryptocurrencies while retaining access to their funds through representative tokens. When you stake your digital assets in a liquid staking solution, you receive a liquid token in return. These tokens represent your staked assets plus accrued rewards and can be used in various DeFi applications, traded, or converted back into the original cryptocurrency. This method eliminates the illiquidity problem inherent in native staking, providing a dynamic alternative for users who seek both the rewards of staking and the liquidity necessary for other investment opportunities.

Both staking methods aim to enhance network security and validate transactions but offer different levels of liquidity and flexibility, catering to the varying needs and strategies of cryptocurrency holders.

Delegation Tutorials

Liquid Staking + Restaking Strategy

Rewards Estimation

Ethereum Staking expected APY: 3-4%

Plus Eigenlayer points (anticipated airdrop)

Plus anticipated AVS airdrops

Withdrawal Period

- The lock-up period is 7 days. After 7 days, you can click [Withdraw] to redeem Liquid ETH

- Liquid ETH can be converted to ETH at any time

Operation method

Thank you for choosing Chainbase Staking as your trusted EigenLayer validator. We are honored to have you as one of our contributors and a crucial member for securing Ethereum network.

- Customer Support: 24/7 customer service is provided

Website:https://staking.chainbase.com

Twitter:https://twitter.com/ChainbaseVA

Email: Staking@Chainbase.com